Vice Chancellor of the Methodist University of Ghana and an economist, Professor William Baah-Boateng, has attributed the recent appreciation of the Cedi to favourable commodity prices and improved reserve accumulation by the government in collaboration with the Bank of Ghana.

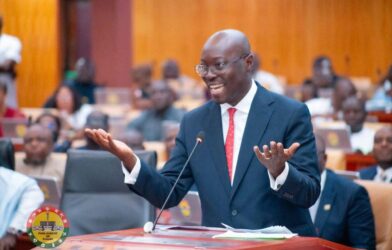

Speaking at a roundtable discussion organised by Channel One TV on the topic John Mahama 2.0: A thematic assessment of year one on Tuesday, January 13, 2026, Professor Baah-Boateng said external sector developments have played a critical role in stabilising the local currency.

“What caused the Cedi appreciation? One of them is favourable gold and cocoa prices. Over the year, we have enjoyed that. Also, the government ensured that, together with the Bank of Ghana, we accumulated our reserves,” he said.

He explained that stronger reserves place the economy in a better position to respond to external shocks.

“So, if you have reserves and you have a challenge, you should be able to manage,” he added.

Professor Baah-Boateng also weighed in on public concerns about the Bank of Ghana’s involvement in the foreign exchange market, stressing that central bank intervention is a legitimate part of exchange rate management.

He noted that exchange rate systems operate along a spectrum, ranging from fixed to fully flexible regimes, with managed floating systems in between.

“When you take exchange rate management, there are eight management regimes. There is an extreme, which is a fixed exchange rate, and then we have the flexible exchange rate. In between these two is the managed one. What we are implementing is the managed floating,” he explained.

According to him, under a managed floating regime, the central bank is expected to intervene when necessary to stabilise the market, but not to control it entirely.

“The central bank will come in when the need arises. It cannot sit and manage everything. So the role of the central bank in managing the exchange rate is very important. How they manage it is what we can talk about. But we cannot sit to say that they cannot get involved,” he said.